Lexington Law Reviews 2023 - Pricing, Features, Pro's & Con's

Lexington Law Firm is one of the prime companies on our review list, and it is solely due to their services. Lexington Law is a credit repair company that assists in modifying inconsistencies or questionsable information that affects the credit rating. According to the company, it has removed more than 1 million negative items from their clients’ credit reports in the last year. Our team members were keen to learn about how Lexington Law worked efficiently and got over 21 negative items deleted from their list during the process.

Overview | Lexington Law Reviews

What is Lexington Law – Leading the industry since 1991, Lexington Law has been a remarkably successful and effective credit repair company. The team is comprised of lawyers and experts/professionals who help you repair your credit score and boost it.

It is known for its excellent services and timely deliverable. My team member reviewing Lexington Law Firm got more than 21 negative items deleted from his credit report. Known for its industry experience, Lexington Law has been an inspiration to all the latest credit repair businesses. Lexington law reviews are increasing day by day and major of the reviews are positive.

It still has not lost its place even after 30 years of starting.

They have a combined team of attorneys, counselors, industry experts, and finance masters who work the best for you and bring a clean wipe on your credit report.

Lexington Law Services

Helping over 500,000 clients and removing over 10 million negative items, Lexington Law Firm has been the best choice for the past 30 years. Moreover, they are known for removing the toughest of items from the credit reports.

These include collections, bankruptcies, liens, charge-offs, repossessions, judgments, and foreclosures much quicker than other credit repair managers in the industry.

It has been the most trustable choice and is available all over the United States of America. You name the state, and they are available there, let it be Ohio, Alaska, Florida, Virginia, Washington, or any other state from the USA; they are one contact form away.

Lexington Law Features

It is hard to find a business that allows a one-to-one person who works dedicatedly to give your services; Lexington Law is one of those companies.

When you join the program, you get a free credit report summary or credit report consultation.

There are two benefits to this,

- You get a clear picture of problems on your credit report.

- Help you in understanding how Lexington Law will solve those problems.

The free credit report consultation also helps you understand which would be the right option to choose in solving the problem. Lexington Law has always worked towards the comfort level of their clients.

Lexington Law Firm has a lot of other legal techniques to remove the negative items from your list. They can remove any bankruptcy above seven years or remove entries from vendors no longer in the business. On the other hand, they also contact the creditors and challenge them to remove the negative entries when they are sure.

Get your Credit Fixed With Lexington Law Credit Repair Company and Boost Your Credit Score Like Never Before.

How much does Lexington Law Cost | Pricing

Knowing about the many benefits of this sofware you might have a question arising in mind about how much does lexington law cost but it is here the program stands out among it competitors. The Lexington Law costs are very much affordable. By looking at the Lexington law reviews and ratings mentioned at the end, you will get to know about the value for the pricing.

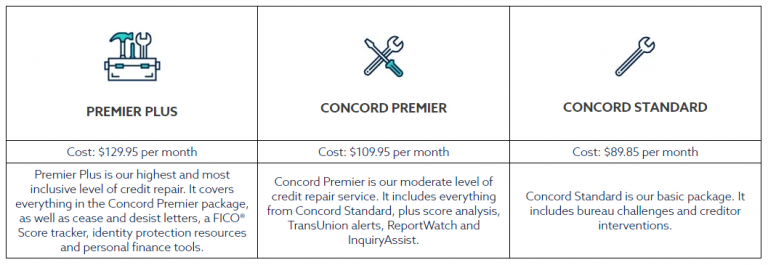

Following are the Lexington Law prices / different plans to meet different needs!

Lexington Law Prices Per Month

Concord Standard Basic Plan - $89.85 per month

Lexington Law’s cost for basic plan is $89.85 per month. This is the most cost-effective program Lexington Law firm has to offer. Through this plan, you will receive a free credit report consultation. They will be in contact with creditors and credit bureaus on your behalf to help dispute items. This plan is good for anyone who has just a few items they wish to dispute from their credit report.

- Bureau Challenges

- Creditor Interventions

Concord Premier Moderate Plan - $109.95 per month

Starting at $109.95 per month, and providing you alerts on your credit that inform you when and if your credit rating has changed. You will also get an analysis of your credit report each month, along with InquiryAssist that is an add-on service that can help you deal with overly frequent inquiries. It’s specifically designed for those who require greater vigor in credit repairs, such as multiple issues that affect your credit score. This plan includes:

- Bureau Challenges

- Creditor Interventions

- Score Analysis

- TransUnion Alerts

- ReportWatch

- Inquiry Assist

Premier Plus Advanced Plan - $129.95 per month

The best and most attractive plan, the lexington law premier plus plan, starts at $129.95 per month and covers everything from the standard and premier plan. Additionally, It adds services for cease and desists letters, a FICO score tracker, identity protection resources, and personal finance tools.

- Bureau Challenges

- Creditor Interventions

- Score Analysis

- TransUnion Alerts

- ReportWatch

- Inquiry Assist

- Cease & Desist Letters

- FICO Score Tracker

- Identity Protection

- Personal Finance Tools

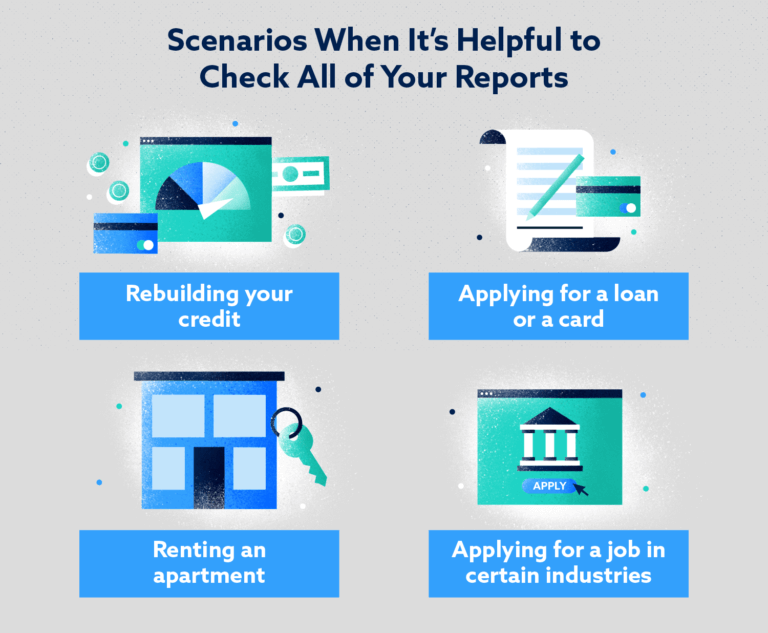

What Does Lexington Law Credit Repair Cover?

Lexington Law works with their clients to make sure that their credit scores only contain authentically announced accurate, exact, and fully verified reports.

They will assist the customer to determine the problematic records and then resolve or correct negative issues in their credit documents. They accomplish this by providing three different price plans which are described above:

With the help of Lexington Law Reviews, we get to know what it truly covers.

What Does Lexington Law Credit Repair Does NOT Cover?

They can (should) not ensure that you will experience positive results and cannot guarantee that your credit score/rating will improve.

The Fair Credit Reporting Act has explicit resolutions and agreements that prohibit credit repair firms to deceive consumers about their creditworthiness. In accordance with the guidelines laid in the CROA the credit repair firm “cannot promise” the fixing of credit repair problems.

With the help of Lexington law reviews, we get to know what it truly not covers.

Pro's & Con's | Lexington Law Credit Repair Reviews

Pros

- Experienced in the Industry

- Exceptional Customer Service

- Free Consultation

- Starightforward Service Plans

- Online Chat Available

- Multiple Pricing Models

- Extensive Educational Resources

Cons

- Expensive

- Additional Charges for a Detailed Report

- BBB Rating Needs Improvement

Make sure to check out some of our most read informative topics:

How to cancel Lexington Law Account ?

You are able to cancel or deactivate your Lexington Law account at any time by calling 800-341-841. If you are dissatisfied with the quality of service you receive or have any concerns about the process of repairing your credit, you can reach client support at 1-888-793-3000. Their service hours are from Monday – Friday, 7am-7pm MST.

Is Lexington Law worth it ?

Yes, Lexington Law is worth the try. Major of the Lexington Law Reviews have a five-star rating. Lexington law has been popular and effective for people who do not have time to repair their own credit. Its main focus is on removing incorrect or doubtful negative items found on your credit report by an analysis of the credit score, credit dispute disputing escalation, and credit score analysis. Lexington Law firm credit repair has a long history of success. The company has real lawyers on staff, and the team stays current on the ever-changing laws governing dispute resolution and credit reporting. So, now if you have any questions regarding “Who can help me fix my credit”, Lexington Law is always by your side.

Credit Saint vs Lexington Law Reviews

Credit Saint and Lexington Law Firm have both provided high-quality credit repair services to a numerous customers since their first encounters with the industry of credit repair. Both credit repair businesses offer customers three repair levels of administration, a free credit counselor and a way to open online-based customer accounts.

Credit Saint operates on a 45-day dispute cycle. That means they issue a new round of disputes on credit reports every 45 days. However, Lexington Law is quite in the dark regarding the pace that they provide their services.

Credit Saint seems to give an online degree of transparency with regards to its credit repair options and prices as compared to Lexington Law. Regarding additional services and sources, Lexington Law reviews provide additional options over Credit Saint.

Lexington Law firm credit repair additionally receives more accurate surveys than the majority of organizations within the credit repair business which includes Credit Saint. Regarding reviews, Lexington Law clients appear to be the most satisfied with Lexington Law customer services.

Credit Repair Scams

Numerous credit repair firms are knowingly promising outcomes. There are many scams that target consumers. The file segregation scam that a particular person or company will offer you an employee Identification Number (EIN) that you can use instead of Social Security Number when you apply for credit which is not legal. Another one is the Credit Privacy Number (CPN), created by scammers to use in place of your Social Security Number at time of applying for credit. CPN is a fake Social Security Number which are made using someone else’s identity. The use of one could be considered identity theft.

Lexington Law Alternatives

Lexington Law Credit Repair Reviews | Conclusion

Lexington Law is known for its experience and easy service. It is expensive, but the program’s features help you with a much cleaner wipe on your credit report compared to other credit repair services. If you’re in the middle of a good credit but are looking to get rid of a few things to improve your credit score or you require an overhaul completely, Lexington Law can help get you back on track to improve your score on credit.

Lexington Law credit repair reviews – Lexington Law is a company which specializes on credit restoration. Lexington Law is one of the most reputable credit repair firms with the most knowledgeable experts to advocate for you. Lexington Law stands out from other firms because they have a whole team of attorneys and financial experts to help you.

Lexington credit repair has more than 3000 verified client reviews on BestCompany.com. +50% of the Lexington Law Reviews have a five-star rating. When compared to the other businesses that we have included on our credit repair listing, Lexington Law receives, the greatest number of reviews and has the highest rating and the most positive reviews. The majority of Lexington Law reviews praise and applaud Lexington Law customer service. In addition, many of the Lexington Law reviews also provide specific information about improvement in credit scores.

Lexington Law Ratings:

Usefulness

User-Friendly

Price

Support

Frequently Asked Questions

Lexington Law is a credit repair company that assists in modifying inconsistencies or questionsable information that affects the credit rating. Credit repair agents analyze your credit reports and financial information. According to the company, it has removed more than 1 million negative items from their clients’ credit reports in the last year.

Lexington Law is absolutely legit! Lexington Law reviews include building strong relationships with all the stakeholders and has been part of the industry for a very long period of time.

In the battle of Sky Blue vs Lexington Law credit repair programs, our review says that both credit repair services are worth paying for. Both has great features. Lexington Law has its own benefits which makes it stand out.

Lexington Law is very pocket friendly. It has 3 different plans starting from $89.85 per month for the basic plan & going up to $129.95 per month for the premier plus plan.

A score of 666 is deemed “fair”. It is less than the average U.S credit score. Scores between 670 – 739 are considered to be good.

The length of time it takes for Lexington Law to repair credit depends on the individual client’s credit situation and the specific negative items they are trying to remove. In general, the credit repair process can take several months to a year, but some clients may see improvements in their credit scores within a few months.

Lexington Law cannot guarantee the removal of negative items from credit reports, as the credit bureaus and creditors are ultimately responsible for determining what information is included on an individual’s credit report. However, the company has a track record of helping clients improve their credit scores by successfully challenging and removing negative items.